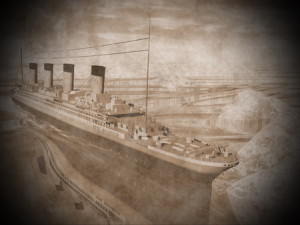

Five years before his ship, the Titanic, sank, Captain Edward J. Smith gave this rosy assessment of his experience: “When anyone asks me how I can best describe my experience in nearly forty years at sea, I merely say, “Uneventful” … I have never been in any accident of any sort worth speaking about. I have seen but one vessel in distress in all my years at sea. I never saw a wreck and never have been wrecked nor was I ever in any predicament that threatened to end in disaster of any sort.” Ironic, isn’t it?

Five years before his ship, the Titanic, sank, Captain Edward J. Smith gave this rosy assessment of his experience: “When anyone asks me how I can best describe my experience in nearly forty years at sea, I merely say, “Uneventful” … I have never been in any accident of any sort worth speaking about. I have seen but one vessel in distress in all my years at sea. I never saw a wreck and never have been wrecked nor was I ever in any predicament that threatened to end in disaster of any sort.” Ironic, isn’t it?

Truth be told, though, many of us take it for granted that we will walk through our days peacefully with the sun shining down on our bliss. It doesn’t take long for reality to set in when we have to suddenly pull out our umbrellas for an unexpected storm.

It’s those unexpected storms in life that insurance is really for. Will you ever need it? Let’s hope not. But not many people want to take that chance. Insurance is all about risk transfer. With insurance, you are buying a promise. It’s a promise that you and your property will be indemnified, or restored to the state you were in before the loss.

The concept of insurance can be traced back to the earliest human societies. Chinese and Babylonian traders had a form of insurance in the third and second millennia BC. It was a transfer of risk in the simplest terms. They would divide up the cargo between many ships to limit the loss should any one ship capsize, spreading the risk among many to minimize a loss. It’s the same thing when you pay an insurance premium to your insurance company. Many policy holders pay in to the company and in turn, when one suffers a loss, the insurance company pays the claim.

Of course, insurance can be complex. But complicated or uncomplicated—it is there when you need it. Don’t make Captain Smith’s mistake. After all, none of us is immune to the little and big storms of life. We’ll hold the umbrella for you!